Damage with your car, motorbike, moped, scooter or bicycle

Have you sustained damage in traffic with your car, motorcycle, moped or scooter? For the most common types of damage, we will explain how to report a damage, what we need from you and how we will settle your claim.

Cosmetic car damage

Get damage repaired through the Aon Damage Service

- Within the Netherlands, you get a free loan car while your car is being repaired

- You have lower deductible

- We pay the invoice, less your deductible, directly to the repair company

Report damage and view claim file in MyZone

Report damage immediately

- Report damage via MyZone at your convenience 24/7, without queuing

- Add photos and attachments directly to allow us to process your claim fully and quickly

- Track your claim and ask a question whenever you like

What to do in case of traffic collision

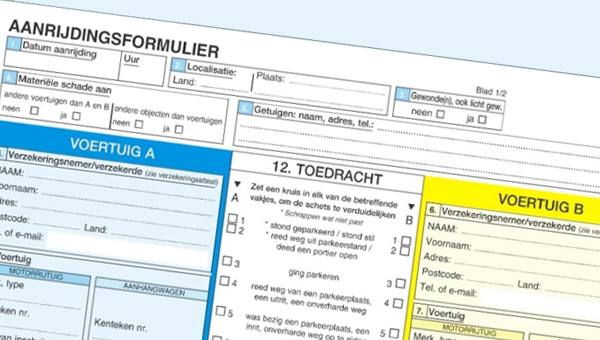

Have you had a collision with another person involved? If so, always fill out a European claim form (together with the other party) and take photos of the situation and damage.

Send us the European claim form

When should you call the police?

Collision with a wild animal

Single-vehicle collision

Are you the other party?

European accident form: download it and attach it to your claim file

In case of a collision, we need a fully completed European Accident Statement (EAS) from you. If you have not already filled it in, you can download it here. Then report the damage via MyZone and add the accident form to your claim file.

Have an emergency?

More information on damage with or to your means of transport

How do we process your claim?

Report your damage online

Complete your report

Processing damage

Completed

What you are insured for

Whether damage to your vehicle is insured depends on the basic cover you have chosen. Here is an overview of which damages are insured with which cover.